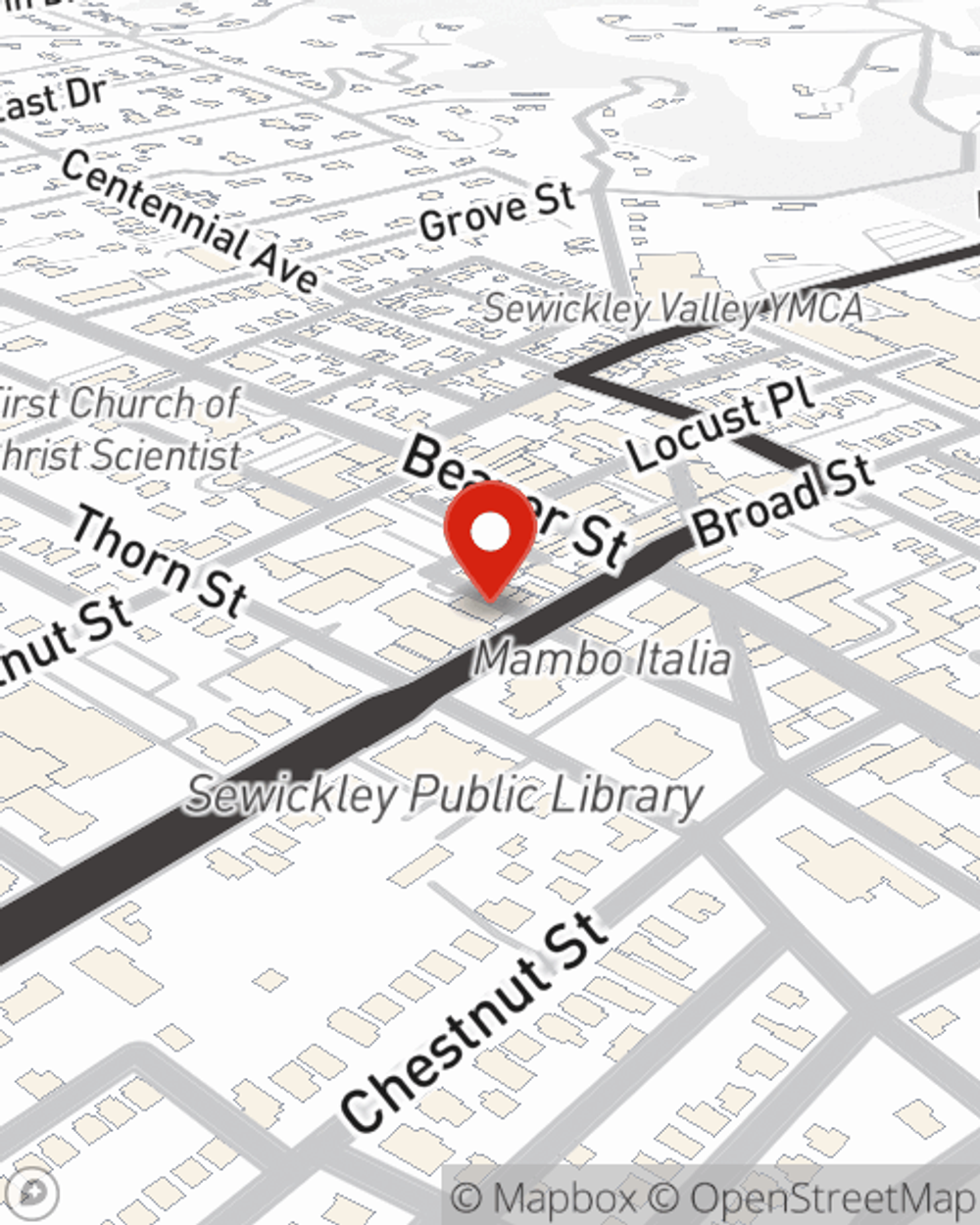

Business Insurance in and around Sewickley

Researching coverage for your business? Search no further than State Farm agent Lindsay Brown!

No funny business here

State Farm Understands Small Businesses.

Operating your small business takes hard work, creativity, and quality insurance. That's why State Farm offers coverage options like a surety or fidelity bond, business continuity plans, errors and omissions liability, and more!

Researching coverage for your business? Search no further than State Farm agent Lindsay Brown!

No funny business here

Protect Your Future With State Farm

At State Farm, apply for the great coverage you may need for your business, whether it's an art school, a veterinarian or a barber shop. Agent Lindsay Brown is also a business owner and understands what you need. Not only that, but personalized insurance options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage can't be beat.

Ready to discuss the business insurance options that may be right for you? Stop by agent Lindsay Brown's office to get started!

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Lindsay Brown

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.