Renters Insurance in and around Sewickley

Renters of Sewickley, State Farm can cover you

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

Your rented townhome is home. Since that is where you relax and spend time with your loved ones, it can be beneficial to make sure you have renters insurance, even if you think you could afford to replace lost or damaged possessions. Even for stuff like your lamps, tablet, video games, etc., choosing the right coverage can help protect your belongings.

Renters of Sewickley, State Farm can cover you

Coverage for what's yours, in your rented home

Why Renters In Sewickley Choose State Farm

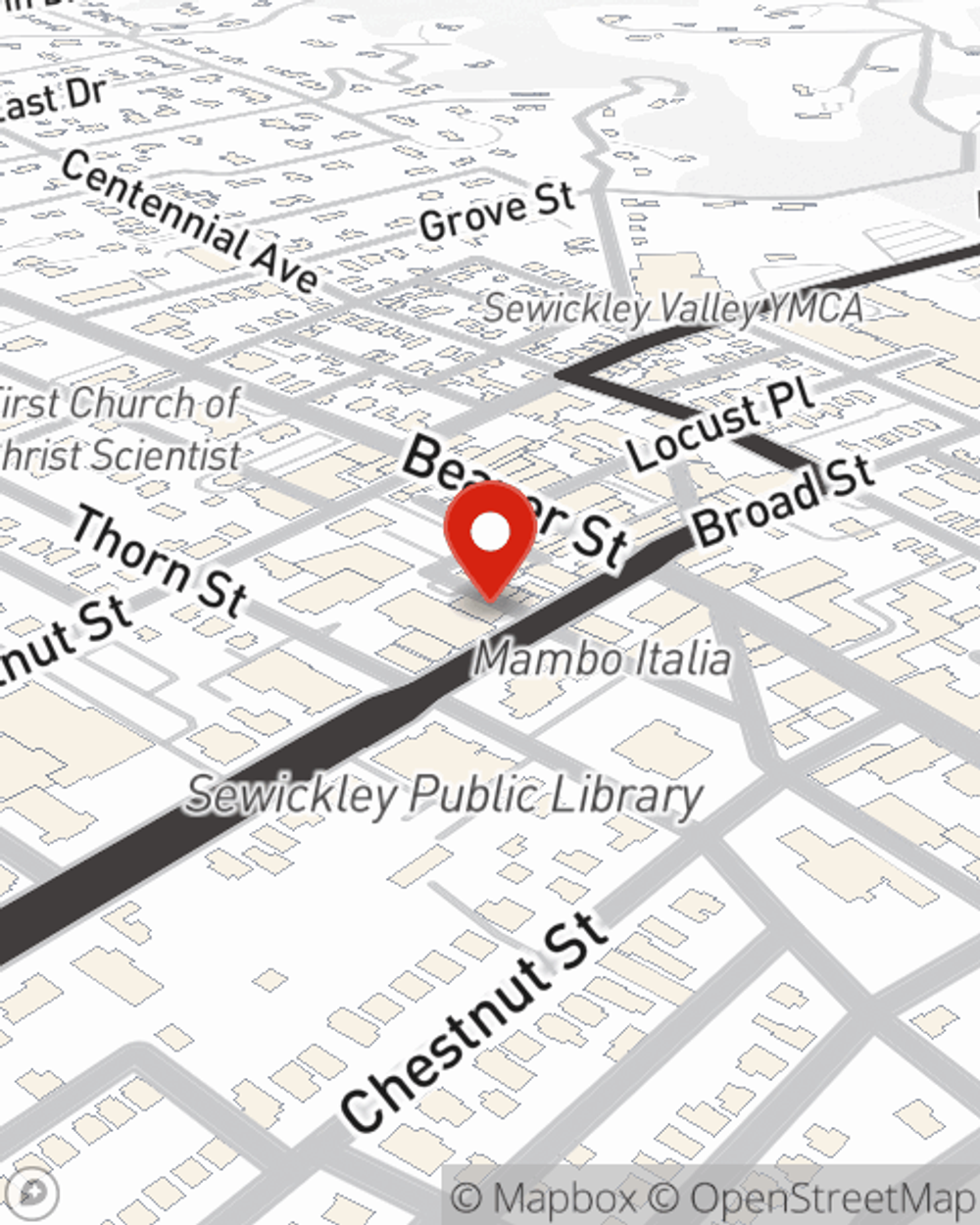

It's likely that your landlord's insurance only covers the structure of the home or condo you're renting. So, if you want to protect your valuables - such as a smartphone, a stereo or a bicycle - renters insurance is what you're looking for. State Farm agent Lindsay Brown has the knowledge needed to help you understand your coverage options and protect your belongings.

Don’t let the unknown about protecting your personal belongings make you unsettled! Visit State Farm Agent Lindsay Brown today, and see how you can benefit from State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Lindsay at (412) 534-9006 or visit our FAQ page.

Simple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Lindsay Brown

State Farm® Insurance AgentSimple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.